The banking industry is a prime target for cybercriminals due to the sensitive financial information and significant assets it handles.

As cyber threats become more sophisticated, banks must adopt advanced security measures to protect their networks, data, and customers.

The PICUS Security Validation Platform offers a robust solution for assessing and enhancing cybersecurity systems in the banking sector.

This article explores the benefits of using PICUS for banks and how it can transform their approach to cybersecurity.

Understanding the PICUS Security Validation Platform

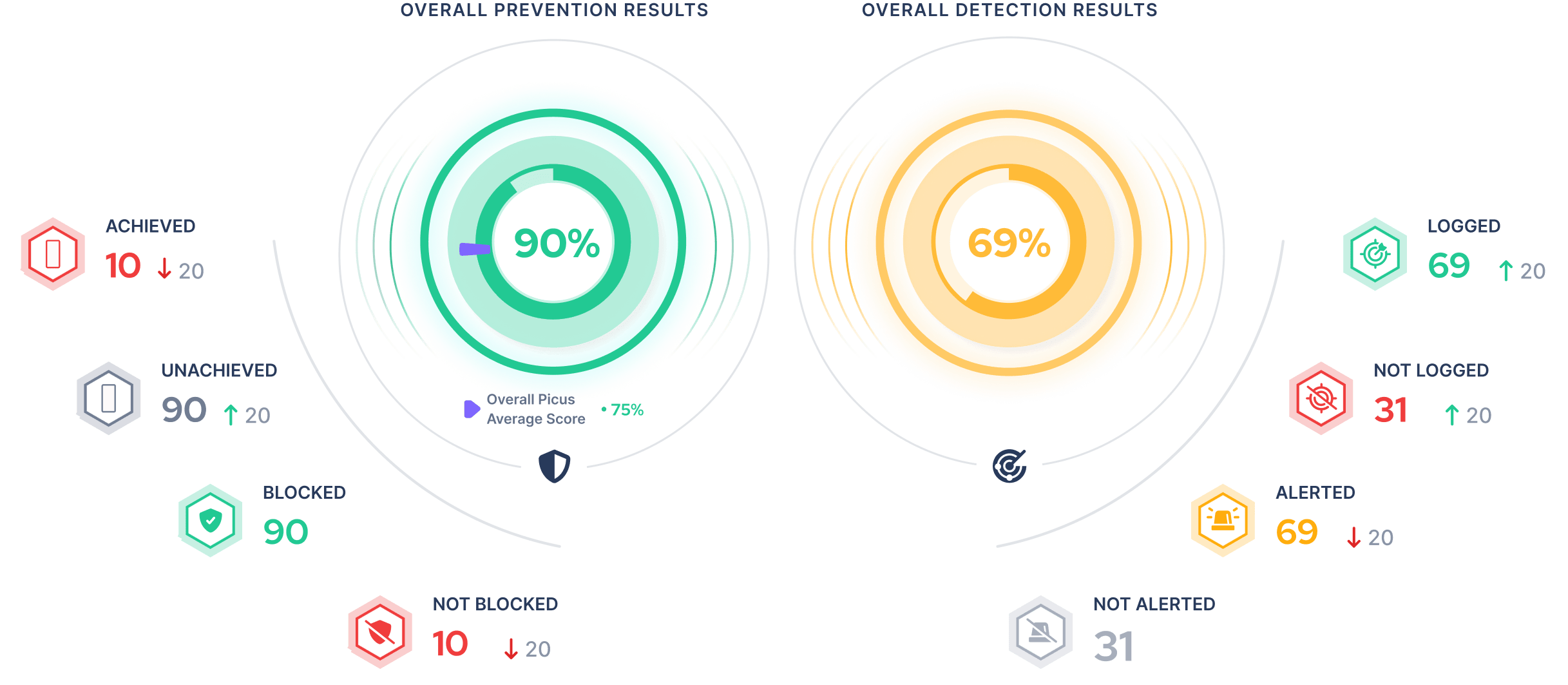

The PICUS Security Validation Platform is a cutting-edge solution designed to simulate real-world cyber attacks and continuously test security controls.

It enables banks to identify vulnerabilities, measure the effectiveness of their existing security measures, and implement improvements.

With its comprehensive suite of tools, PICUS empowers financial institutions to maintain a strong and proactive security posture.

Benefits for the Banking Industry

- Continuous Security Assessment:

PICUS allows banks to perform continuous security assessments, simulating various attack scenarios to test their defenses.This ongoing validation ensures that security measures are always up-to-date and effective against the latest threats, providing banks with a dynamic and resilient security posture.

- Proactive Threat Identification:

By simulating real-world attacks, PICUS helps banks identify vulnerabilities before they can be exploited.This proactive approach enables banks to address security gaps promptly, minimizing the risk of breaches and ensuring the safety of their customers’ financial data.

- Detailed Reporting and Insights:

PICUS generates comprehensive reports that detail vulnerabilities, attack simulations, and remediation recommendations.These reports provide banks with actionable insights, allowing them to communicate effectively with stakeholders about their security posture and the steps needed to enhance it.

- Efficient Resource Utilization:

The automated testing capabilities of PICUS reduce the time and effort required for manual security assessments.This efficiency allows bank security teams to allocate their resources more effectively, focusing on strategic security enhancements and other critical tasks that add value to the organization.

- Regulatory Compliance:

Compliance with industry regulations and standards is a critical concern for banks.PICUS assists financial institutions in ensuring that their security measures align with regulatory requirements such as GDPR, PCI DSS, and ISO/IEC 27001.

This support helps banks avoid legal penalties and maintain a strong compliance posture.

- Enhanced Customer Trust and Satisfaction:

By utilizing PICUS, banks can offer their customers a higher level of security assurance.The ability to continuously validate and improve security measures builds trust and demonstrates a commitment to protecting customers’ financial interests, leading to increased customer satisfaction and loyalty.

- Risk Mitigation:

PICUS provides banks with the tools to identify and mitigate risks before they can impact the organization.This proactive risk management approach is crucial for maintaining the integrity and reliability of banking operations, which are essential for customer trust and regulatory compliance.

- Competitive Advantage:

In the competitive banking market, offering advanced security validation services with PICUS can set banks apart from their competitors.The ability to deliver proactive, data-driven security assessments and solutions enhances the bank’s reputation and attracts new customers seeking top-tier financial security.

Terrabyte: Your Authorized PICUS Distributor in Thailand

For banks in Thailand, Terrabyte is the authorized distributor of the PICUS Security Validation Platform. Terrabyte are distributor for cyber security solutions which always give access to a robust security validation tool that can transform your security measures and deliver unparalleled value to your customers.

In conclusion, the PICUS Security Validation Platform offers banks a powerful solution for assessing and enhancing their cybersecurity systems.

With continuous security assessments, proactive threat identification, detailed reporting, and efficient resource utilization, PICUS empowers banks to deliver superior cybersecurity solutions.

By ensuring regulatory compliance and enhancing customer trust, banks can gain a competitive advantage in the market.

With Terrabyte as trusted partner in Thailand, you can confidently integrate PICUS into your security strategy, providing exceptional protection for your customers and your financial institution.

For more information on how PICUS can benefit your bank’s cybersecurity and for demo product, contact Terrabyte, the authorized distributor in Thailand.